Tax tip markup calculator

Fill out our contact form or call. Multiply the price of your item or service by the tax rate.

Markup Calculator And Discount Calculator

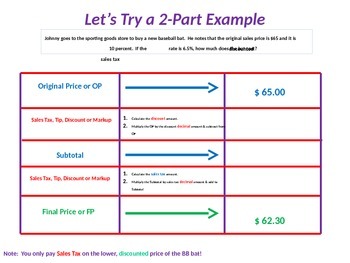

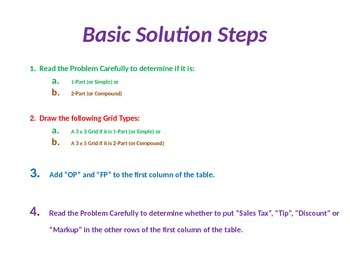

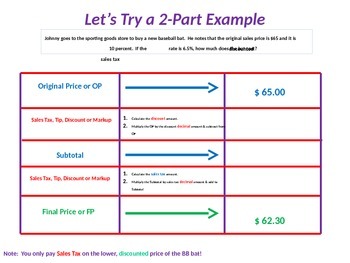

To find the total cost add the tax or markup to the original amountsolution.

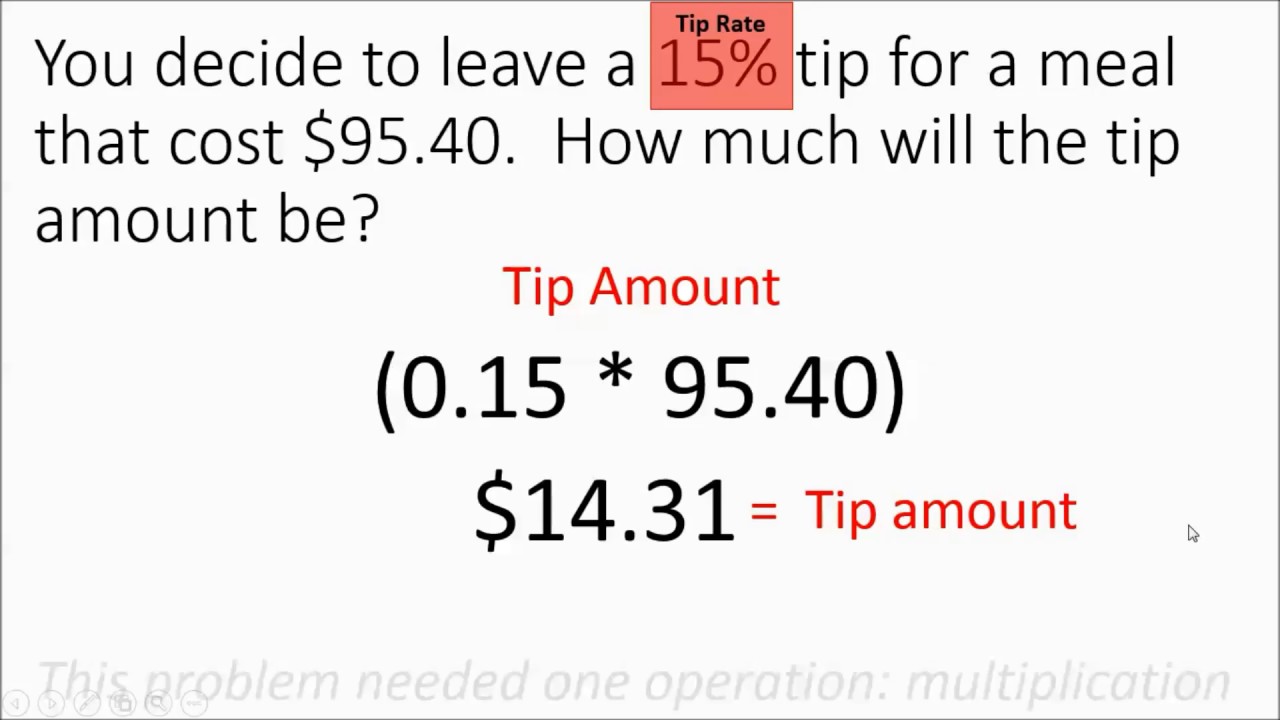

. How do you figure out how much. To calculate tip multiply the total check by 1 plus the decimal percentage tip youd like to leave. To get the final sales amount multiply the sales tax amount by the sum.

A tip or gratuity. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. If you wanted to leave a 20 tip you would add 1 to 020 to get 120.

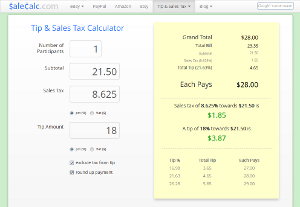

Alternatively you can calculate the percentage tip and then add it to the bill. The Shared Bill Tip Calculator considers the cost of the service number of people and chosen tip percentage to calculate the tip per person as well as the total cost per person. For example if you pay the supplier 15 for a product and you want to add a 20 markup your.

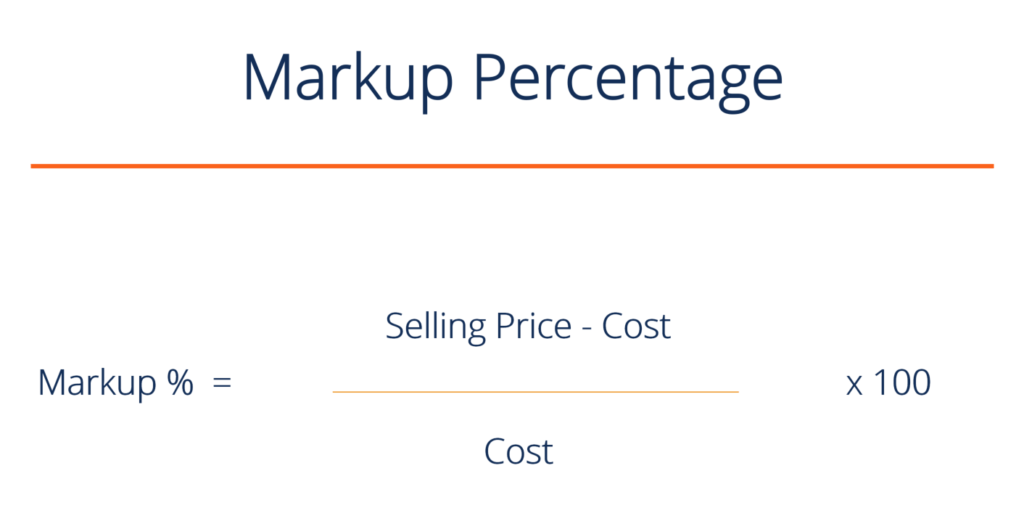

The first step in calculating markup from the. Multiply the bill by 120 to get the total amount youd leave including tip. If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal.

Price with markup Cost 1 - Margin. The entire set of information required for its calculation is already contained in the income statement. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase.

To find the tax or markup multiply the rate by the original amount. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Markup 20 of 850285170.

877 729-2661 to speak with Netchex sales and discover how our payroll software for small business can help you. The tip calculator with tax tool is very a helpful tool for anyone going out to a restaurant bar or anywhere else where tipping is anticipated. To calculate a markup price via the margin percentage one needs to solve the equation.

Markup rate 20 of 85. First give a decimal representation of the sales tax. For example to get a profit margin of 20 with a cost of 200.

To find the total cost add the tax or markup to the original amountSolution Price of apples 85. Then use this number in the. To calculate a 20 markup take your cost of goods sold and multiply it by 02 to get the markup.

To find the tax or markup multiply the rate by the original amount. Tax Tip Markup Calculator.

Calculate Tax Tip Discount Markup Using Of Increase Decrease Schooltube

Markup Calculator And Discount Calculator

Tax Tip And Discount Youtube

Tax Tip Markup Discount And Interest 8 4 Lessons Blendspace

Consumer Math Sales Tax Discount Tip And Markup Calculation Summary

Markup Calculator Markup Rate Markup Price Calculator

Markup Calculator Calculate The Markup Formula Examples

Tip Sales Tax Calculator Salecalc Com

Margin Calculator

Markup Percent Discount Percent Change Increase Decrease Tax And Tip Unit

Tax Tip Markups And Commission Bundle Distance Learning Digital And Print

Consumer Math Sales Tax Discount Tip And Markup Calculation Summary

Consumer Math Sales Tax Discount Tip And Markup Calculation Summary

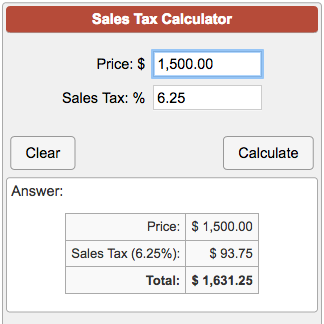

Sales Tax Calculator

Markup Calculator And Discount Calculator

Discount Tax Tip Markup Commission Youtube

Sales Tax Tip And Markup Youtube