401k limit calculator

You only pay taxes on contributions and earnings when the money is withdrawn. This simple 401k Calculator will show what role your 401k will play in plotting your path to your golden years.

Retirement Services 401 K Calculator

Extension of the length of the original manufacturers warranty usually for one or two years.

. This federal 401k calculator helps you plan for the future. As a single filer that brings their top tax rate from. If your business is an S-corp C-corp or LLC taxed as such please consult with your tax professional.

The 401k catch-up contribution limit for those age 50 and older is 6500. Their taxable income would drop to 77500. The 401k contribution limit is 19500.

Not A Math Whiz. For example if you retire at age 65 your last contribution occurs when you are actually 64. Also pre-tax contributions are subject to the annual IRS dollar limit.

You might also consider opening an individual retirement account IRA to further build your savings. Traditional IRA comparison page to see what option might be right for you. For employees over 50 the combined limit is 64500 in 2021 inclusive of the 6500 catchup contribution.

The 2022 401k individual contribution limit is 20500 up from 19500 in 2021. Your annual gross salary. You can still analyze your 401K or locate old 401Ks using a new service called Beagle.

This contribution limit includes deferrals that you elect to be withheld from your paycheck and invested in your 401k on a pre-tax basis. The limit for employer and employee contributions combined is 58000. 401k Catch-up Contribution Eligibility.

Contributions are automatically withdrawn from employee paychecks and invested in funds of the employees choosing from a list of available offerings. The contribution limit for those 50 and older is 26000 which includes the catch-up contribution limit of 6500. In the following boxes youll need to enter.

A 401k rollover is when you transfer your funds from your old 401k from your previous employer to an individual retirement account IRA or to a new 401k plan set up with your new employer. If you are 50 years old or older you can also contribute up to 6500 in catch-up contributions on top of your individual and employer contributions. The annual Solo 401k contribution consists of 2 parts a salary deferral contribution and a profit sharing contribution.

The total annual contribution limit for 2022including your and your employers contributionsis the lesser of your annual salary or 61000 67500 if you qualify for catch-up. The total allowable contribution adds these 2 parts together to get to the maximum Solo 401k contribution limit. Simply provide the required inputs variables and quickly calculator what your 401k will grow to in the future.

You can use our IRA Contribution Calculator or our Roth vs. Making a withdrawal from your Fidelity 401k prior to age 60 should always be a last resortNot only will you pay tax penalties in many cases but youre also robbing yourself of the tremendous benefits of compound interestThis is why its so important to maintain an emergency fund to cover any short-term. For example consider a 55 year old with a 100000 pre-tax salary who contributes the maximum annual limit to their 401k in 2022 plus 2000 in catch-up contributions.

Your 401k plan account might be your best tool for creating a secure retirement. You will receive a. 401ks have an annual contribution limit.

Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match. With a solo 401k you are allowed to make contributions in the role of employee and the role of. The Best 401k Companies If You Are Under 59 12.

There is no income limit for a Roth 401k. Catch-up contributions are 6500 in 2022. As an investor-owner you own the funds that own Vanguard.

Individual 401k Defined Benefit Plan or SIMPLE IRA. Use our Calculator to calculate how much you could contribute to a SEP IRA based on your age and income. Please note that this calculator is only intended for sole proprietors or LLCs taxed as such.

Pre-tax Contribution Limits 401k 403b and 457b plans. There are two options. In 2022 the maximum is 61000 or 67500 if you are 50 or older.

When you roll over the funds all of the funds to a qualifying IRA or 401k account you do not have to pay taxes on the transfer. You can find out how much your 401k will grow without the help of a financial wizard. BrightScope 401k is no longer a public service.

Beagle will help you analyze your 401K help you locate any old 401Ks you forgot about and provide other services around 401Ks like rollovers 0 interest 401K loans and more. Total 401k Employer. Plus many employers provide matching contributions.

Generally the purchased items must be new not used or floor models and the original manufacturers warranty must not cover a period longer than 12 months. Average 401k Balance at Age 55-64 586486. Contributions to a defined benefit plan are.

If you contribute say 20500 toward your 401k and your employer adds an additional 5000 youre still within the IRS. The 401ks annual contribution limit of 20500 in 2022 27000 for those age 50 or older. Roth 401k The Roth 401k is somewhat different from the traditional 401K as a retirement savings.

As of 2020 the 401k contribution limit for those aged 50 and below is 19500. The Roth IRAs after-tax contributions so qualified. The limit is usually up to 50 of their account value or 50000 whichever is less.

The good news is that this limit does not include employer match contributions. A defined benefit plan as an alternative to a SEP IRA if you would like to contribute more than the 2022 SEP IRA limit of 61000. The limit on each claim is typically 10000 with a 50000 annual cap on the entire account.

Decide if you want to manage the investments in your IRA or have us do it for you. For the 10-year period ended December 31 2021 7 of 7 Vanguard money market funds 67 of 86 Vanguard bond funds 21 of 24 Vanguard balanced funds and 128 of 183 Vanguard stock fundsfor a total of 223 of 300 Vanguard fundsoutperformed their Lipper peer group averages. Some 401k match agreements match your contributions 100 while others match a different amount such as 50.

Make sure that you take advantage of them. Your expected annual pay increases if any. This calculator assumes that the year you retire you do not make any contributions to your 401k.

If your benefits see your contributions matched 100 it means that for every dollar you set aside for retirement your employer will. In 2022 employers and employees together can contribute up to 61000 up from a limit of 58000 in 2021. The 401k compensation limit is 290000.

Solo 401k contribution calculation for a sole proprietorship partnership or an LLC taxed as a sole proprietorship. So if you contribute the annual limit of 20500 plus your catch-up contribution of 6500 thats a total of 27000 tax-advantaged dollars you could be saving towards your retirement.

Roth Ira Vs 401 K Which Is Better For You Roth Ira Roth Ira Investing Ira Investment

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

How Much Should I Have Saved In My 401k By Age

Roth Ira Vs Traditional Ira Roth Ira Investing Traditional Ira Personal Finance Quotes

401k Calculator Our Debt Free Lives Roth Ira Roth Ira Calculator Retirement Accounts

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Investing Investing Money Investing

The Maximum 401k Contribution Limit Financial Samurai

Free 401k Calculator For Excel Calculate Your 401k Savings

The Maximum 401k Contribution Limit Financial Samurai

Solo 401 K A Retirement Plan For The Self Employed Individual Rules Travel Credit Cards Small Business Credit Cards Travel Rewards Credit Cards

What Are The Maximum 401 K Contribution Limits Money Concepts Saving For Retirement 401k

401k Contribution Calculator Step By Step Guide With Examples

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

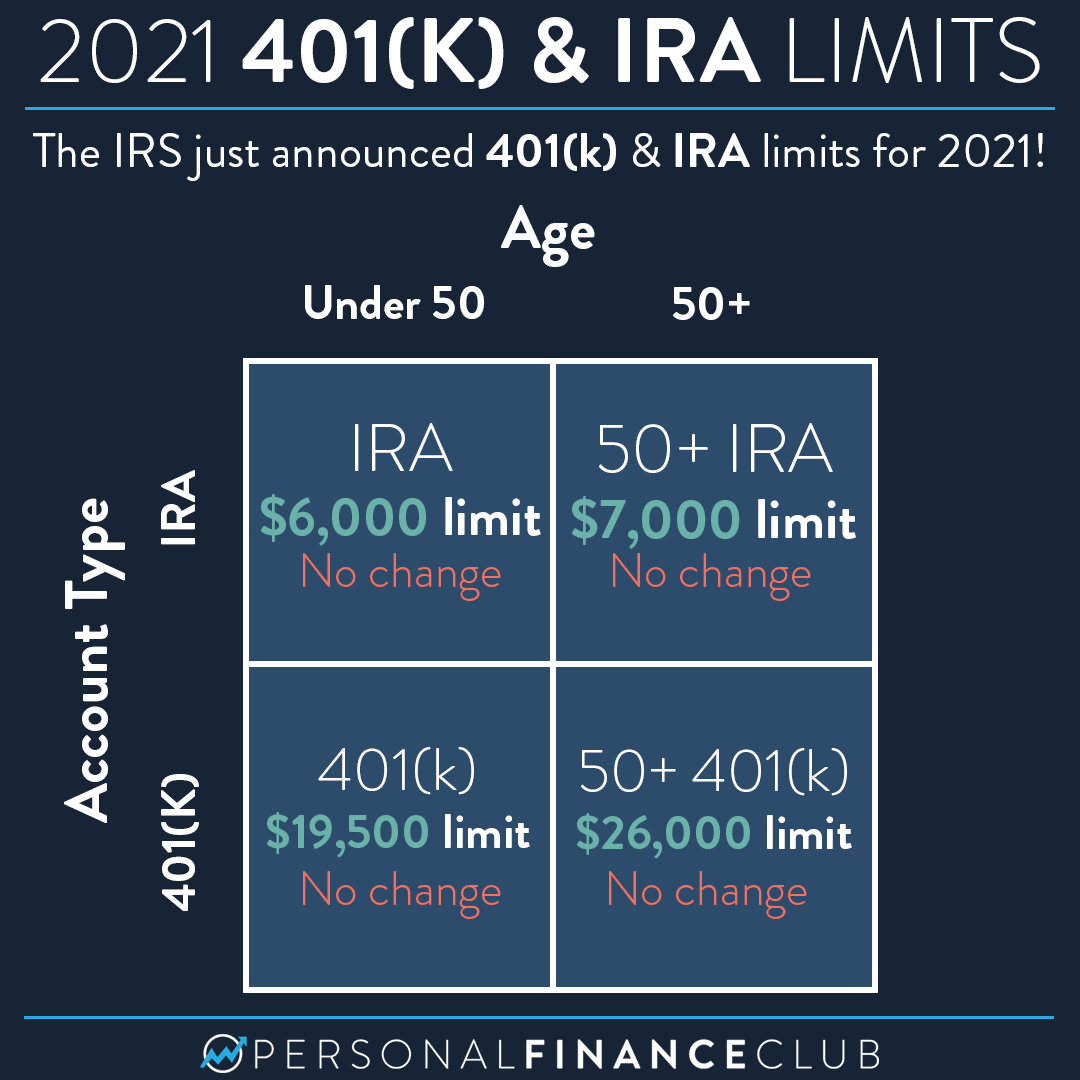

2021 Contribution Limits For 401 K And Ira Personal Finance Club

401k Contribution Limits And Rules 401k Investing Money How To Plan

Customizable 401k Calculator And Retirement Analysis Template

Here S An Example Of How After Tax Contributions Work An Employee Over Age 50 Can Save Up To 62 000 In A Workpl Contribution Retirement Benefits Savings Plan